Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

-

Welcome to The Platinum Board! We are a Nebraska Cornhuskers news source and community. Please click "Log In" or "Register" above to gain access to the forums.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market/Investing/Day Trading/Speculative Trading Thread

- Thread starter That SOB Van Owen

- Start date

Seems like the market was really thinking they were getting 6 cuts, lol.

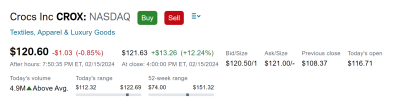

Looking at buying 2 very different companies...

1. $Crox - Low P/E, Usually beats earnings, High ROE, etc... con in my eyes is a healthy amount of debt. LTD to Equity is 168%.

2. $ARLP - Coal company with a healthy dividend (14% with a 214% coverage ratio). Also, balance sheet is trending the right way with liabilities staying in the same ball park, but assets growing. Big concern is what does coal's future look like? I frankly think coal will be around longer than most think, but definitely a concern. Probably why it is trading a a 3.5 P/E.

Thoughts?

View attachment 32253

Hammered the table at $85/share around this post... Had a small position and thought 85 was too cheap.

Nice looking win in the portfolio currently...

I don't get why people thought this.. Only way we get 6 cuts is if something really bad happens in the economy.Seems like the market was really thinking they were getting 6 cuts, lol.

Putting inflation in perspective?

"It's a linear extrapolation, Michael. How big could the error be? 10%?"

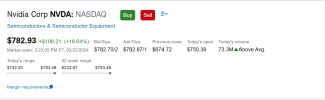

Ive got some NVDA at a 90 average.. i should prob dump more of it

You wanna feel really bad for somebodyIve got some NVDA at a 90 average.. i should prob dump more of it

I owned 400 shares of NVDA at $29 and sold it at $48. I still feel sick to my stomach thinking about that.

Would be 290k from 11k

Last edited:

You wanna feel really bad for somebody

Would be 290k from 11k

My friend who was in commercial real estate lending has been telling me this was all going to blow up in a very ugly way. He's been saying that since he got out back in 2021Commercial real estate feels like a trainwreck in slow motion. Sure hope it doesn't turn into a trainwreck in fast motion....

Commercial real estate a 'manageable' problem but some banks will close: Powell

Federal Reserve Chair Jerome Powell is predicting that more small banks will likely close or merge due to commercial real estate weaknesses, but that the problem is ultimately "manageable."finance.yahoo.com

Wall Street worries banks aren't worried enough about commercial real estate as NYCB turmoil mounts

Regional banks have been setting aside money to deal with future losses on commercial real estate, but in the wake of problems at New York Community Bancorp some analysts now fear it hasn't been enough.finance.yahoo.com

What do you think, manageable problem, or is this just Fed-speak from Powell?

During COVID they refinanced their entire portfolio at all-time low rates. Now those are coming up for renewal and people won't be able to afford the current rates and it looks like there's zero chance we'll see enough cuts to prevent that.

On top of that, if this recent inflation spike becomes a trend, rate increases could be on the table again

During COVID they refinanced their entire portfolio at all-time low rates.

That's true of much of the economy. If you had a loan and a clue, you refinanced. It's probably a big part of why things have held up better lately than some predicted - businesses that otherwise would be struggling right now were able to get more favorable financial terms without bankruptcy. Unless the company's managers are dumbshits on the level of Bed Bath & Beyond...

Last edited:

View attachment 34234

This is crazy ^^^

Saw this yesterday and meant to share it here

View attachment 34235

I don't know what to do with it

This was going around yesterday or the day beforeView attachment 34234

This is crazy ^^^

Saw this yesterday and meant to share it here

View attachment 34235

same…I don't know what to do with it

I just realized the symbol from True Detective is about the same as the Nvidia logo.

View attachment 34270

Bullish...

Similar threads

- Replies

- 26

- Views

- 1K

- Replies

- 13

- Views

- 1K

- Replies

- 2

- Views

- 539

- Replies

- 31

- Views

- 2K